TReDS

- What is TReDS?

Re: Trade Receivables electronic Discounting System (TReDS) is an online electronic platform and an institutional mechanism for factoring of trade receivables of MSME sellers. It enables discounting of invoices through an auction mechanism to ensure prompt realisation of trade receivables.

- How many TReDS platforms are there currently?

Re: There are three platforms registered with RBI for operating as a TReDS platform and Bank of Maharashtra has Tie up with all of them.

- A.TREDS Ltd (Known as Invoicemart)

- Receivables Exchange of India Ltd (RXIL)

- Mynd Solutions (Known as M1 exchange)

- Who are required to register on the platform?

Re:

Participants

Eligibility

Buyer

Corporates including companies and other buyers including Government Departments and Public Sector Undertakings and such other entities as may be permitted by the RBI

Seller

MSME entities as per the definition of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act).

Financier

Banks, NBFC Factors, Financial Institutions and such other Institutions as permitted by the RBI

- What are the documents required for registration?

Re: The documents required are as follows:

- Application Form

- KYC Documents of the Applicant Entity

PAN

Certificate of Incorporation

Memorandum & Article of Association

Address Proof of the registered entity

- KYC Documents of the promoters, administrators, authorised signatories, etc.

- Designated bank related documents

- Master Agreement

- Bank confirmation letter

- What are the Key benefits of TReDS?

Re: Following are the key benefits of TReDS platform

- All Participants

Automated transparent platform

Paperless and hassle free

Cost Reduction

- Benefits to Sellers

Competitive price discovery

Without recourse to Seller

MSMEs have the right to choose the best bid

Payment received on T+l on successful auction

No follow-up with the buyers for payment

Not dependent on single financier

Enhanced productivity and efficient liquidity management

widening the financing options

- Benefits to Buyers

Compliant with MSMED Act, 2006

Can negotiate better terms with MSME Vendors

Lower cost of inputs for Buyers

Lower administrative cost

Can avail extended credit period

Competitive Price Discovery

Efficient cash-flow management

Ensure that their vendors are not strapped for cash / working capital

- All Participants

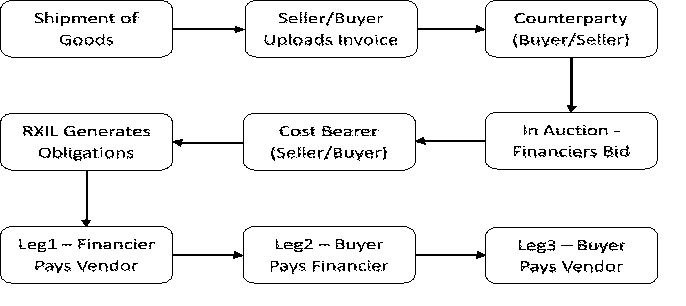

- What is the process flow of TReDs?

- What is the rate of interest?

RoI: RLLR linked Rate