MahaMobile

Try our new Mobile Banking App - MahaMobile

Experience banking at your fingertips with the MahaMobile App. Activate it on your mobile today to view your banking transactions, do instant money transfer to your loved ones, and pay your bill in time from anywhere, anytime.

| Safe | Easy | Convenient |

|---|---|---|

|  |  |

| Send an SMS MAHAMOBILE TO 9223181818 to get the download link or find us on the app stores | ||

| Click the Icons below to download the Application | ||

|  | |

How to Activate Instantly

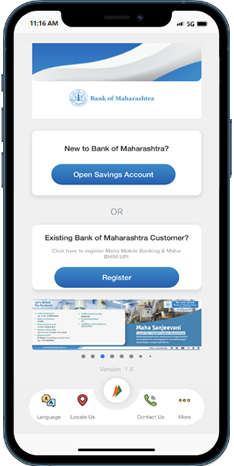

Download and install the Mobile Banking Application from the respective app store and open

Install MahaMobile from relevant App Store

Click on Register button

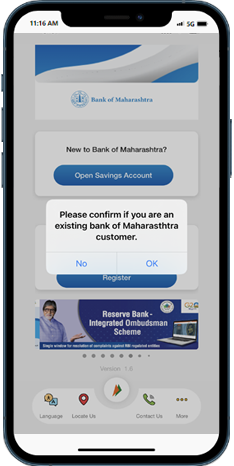

Confirm about existing customer

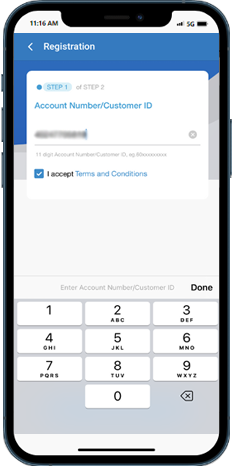

Enter your Customer ID and Accept the terms & conditions

Your User Id is your 11 digit CIF or Customer id Number. if you don’t know your CIF number, contact call center.

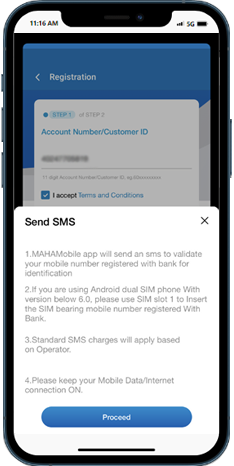

Allow For Send SMS

- Proceed with Send SMS option

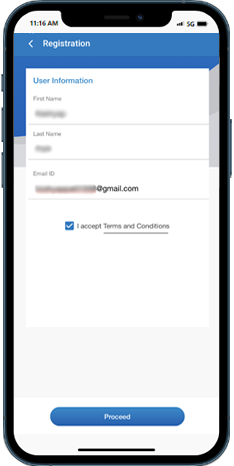

- Fill the form with User information like First name, Last name and email.id

On Submit, an automated SMS* is sent from your bank. In case you get a pop-up asking you to visit branch, you have either not registered your mobile number with the Bank or you are using a SIM other than that of your registered mobile number. For Dual SIM Mobiles phones ensure your registered number is the default SIM.

*Standard charges to send an sms applied

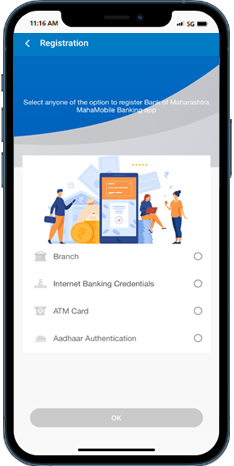

Choose your registration method

You now have four options to complete registration

- Branch : Submit application at branch and verify with the 5 digit token you get on SMS

- Internet Banking : Verify with Net Banking User ID and Password

- ATM Card: Verify with 16 digit Card Number and PIN

- Aadhaar Authentication: Verify with first 6 digit of your Aadhar Number and verify with the 5 digit token you get on SMS

Set your MPIN & MTPIN

- MPIN (Password to login to app)

- MTPIN (Password to authenticate fund transfer & bill pay)

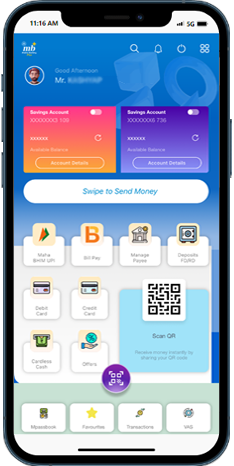

Congratulations! You can now do your transactions

Congratulations! You can now use MahaMobile for over XX banking transactions. For more help, open the side menu to view FAQ, contact our customer care or visit one of our branches near you

What are the features available?

Banking

- Balance Enquiry & Mini Statement for

- Savings & Current Account

- Fixed & Recurring deposit

- Loan Accounts

Fund Transfer

- View/add/modify/delete beneficiaries

- Transfer to accounts within Bank

- Transfer to other bank a/c with NEFT*

- Transfer to other bank a/c with IMPS*

Bill Pay

- Add/Delete billers

- View & pay bills

- Instant bill pay (without biller addition for select billers)

- Check bill payment history

Card Services

- Apply for debit/credit card

- Reset ATM PIN

- Block debit card

Service Request

- Search past transactions

- A/c statement request

- Cheque Book Request

- Cheque Status Enquiry

- Stop Cheque

- Demand Draft Request

- Apply for loans

VAS

- Log Complaint

- Mobile Passbook

- Change MPIN & MTPIN

IMPS

Immediate Payment Service (IMPS) is an instant interbank electronic fund transfer service through mobile phones. It is also being extended through other channels such as ATM, Internet Banking, etc.

NEFT

National Electronic Funds Transfer (NEFT) is a nation-wide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country participating in the Scheme.

Additional Features

- Frequently Asked Questions

- Branch/ATM Locator across India

- Contact Centre Details

Frequently Asked Questions (FAQ)

1. What is Maha Mobile?

Maha Mobile App is a new type of Channel banking solutions offered by Bank of Maharashtra that provides banking solutions on your Mobile Device through an Application (App) with features like Funds Transfer, NEFT, Account Balance, Mobile Recharge, Bill and Utilities Payments, Cheque related services and much more.

2. Are the Transactions done on Mobile Phone App really secure?

Yes, all the transactions done on Maha Mobile App are secured. The Messages or communication originating from your Mobile Phone are encrypted and travel to our Mobile Banking Server in a Secured Mode using the latest and highest level of encryption methodology.

3. Does my Mobile Handset support Maha Mobile App?

Maha Mobile App is compatible with various types of handset on the following operating System.

4. I am using a handset with one of the above given OS? Can I install the app now?

You should have an active Data Service enabled on your phone in order to download and use the Maha Mobile App.

5. I am having only 2G Internet Service, whether your app will work on 2G speeds?

Yes, Maha Mobile App is optimized to work flawlessly even in 2G speeds. However, you may experience slowness while downloading and using the app depending on the Network Signal strength. However you may face issues in accessing certain features like Find ATM/Branches which are resource intensive.

6. Can I access Maha Mobile App while on International Roaming?

Yes, as long as you have Data (Internet) Service activated on your mobile number, subject to availability of the network, you can access Maha Mobile anywhere in the world.

7. Will I be charged for Maha Mobile App?

Maha Mobile App is available totally free of cost. However, Data Access rates will be applicable as per your telecom service provider for using Maha Mobile App.

8. What are the key benefits of this Maha Mobile App?

Maha Mobile App helps its customers to conduct Banking transactions 24 X 7 at his / her convenience from any place just by using his Mobile Phone.

9. Can I use Maha Mobile App in 2 different handsets simultaneously?

No, for security reasons you can use Maha Mobile in one device at once only using MPIN.

10. What is MPIN?

MPIN is Mobile PIN, a 4 digits length PIN that can be used to Login into your Maha Mobile App. MPIN should be set in such a way that it cannot be easily guessed by others and also easy for you to remember.

11. What if I forgot my MPIN?

You can reset you M-PIN by clicking on the Forget MPIN option in the Login Page of Maha Mobile Application.

12. What if I change to a new handset Phone?

You will have to download the app again from the respective App Store and complete the Onboarding Process again.

13. What will happen if I lose my Mobile Phone?

Even if you lose your Mobile Phone, your account details will be safe. To use this App, you need to install the App in new Mobile and onboard again

14. What is Locate Us? What can I do with this feature?

This service will help you to search for Bank of Maharashtra Branches and ATMs through the Map service available on your phone.

15. How to Uninstall the Maha Mobile Plus app from your device?

IOS:

To uninstall Maha Mobile Plus app on iOS, start by finding the Maha Mobile Plus on your device's home screen. Once located, press and hold the app icon until it begins to jiggle. You'll notice an "X" icon appearing on the corner of the app. Tap on this "X" icon to delete the app. A confirmation message will then appear asking if you want to delete the app. Confirm by tapping "Delete." The app will then be uninstalled from your device, and its icon will disappear from the home screen.

Android:

To uninstall Maha Mobile Plus app on Android, begin by opening the Settings menu on your device. From there, navigate to "Apps" or "Apps & notifications," depending on your device. Scroll through the list of installed apps until you find Maha Mobile Plus app. Tap on the app to open its details, then select the "Uninstall" option. You may be asked to confirm your action. Confirm by tapping "OK" or "Uninstall." The Maha Mobile Plus app will then be removed from your Android device.

Service Charges

At present there are no charges levied for the mobile banking application and no charges will be levied for the funds transferred to other accounts within the Bank. For funds transfer to other bank accounts through NEFT, appropriate service charges as per Bank’s guidelines will be debited by the system. In case of Issuance of Cheque Book or Physical Statement of Account courier/ postal charges will be debited to customer’s account if Mode of delivery is “Delivery on Customer’s Address” @ Rs. 50/- per request.

Transaction Limit

Transaction Limits in the Mobile Banking are as follows.

| Sr No | Particular | Transaction Amount Limit |

|---|---|---|

| 1 | Transfer to Own Account | No Limit |

| 2 | Transfer to Other BOM account | 50000/- per day |

| 3 | NEFT | 50000/- per day |

| 4 | Utility Bill Payment | 50000/- per day |

| 5 | IMPS | 50000/- per day |

Who can avail the facility?

- All types of savings bank account holders in the individual capacity or joint account holders operated on either or survivor basis.

- All sole proprietorship firm Current Account and Cash Credit Account holders

Pre requisites for availing MahaMobile Banking Services

The customer should have the following to use the mobile banking application.

- Android, IOS, Windows mobile phone.

- Data Connectivity in the mobile phone